The secret to integrating AI into a legacy business is not buying technology, but systematically de-risking the investment.

- Focus on solving a single, high-impact “Minimum Viable Problem” on your shop floor first.

- Use low-cost pilot programs and Canadian government incentives like SR&ED to prove ROI before major capital outlay.

- Frame AI as a tool to augment the wisdom of your senior staff, not replace them, to ensure successful adoption.

Recommendation: Begin by auditing your operations to identify one specific, measurable bottleneck—like quality control defects or machine downtime—as the target for your first AI pilot.

As the second-generation owner of a manufacturing business in Southern Ontario, you live with a unique kind of pressure. The machinery your parents installed might still run like a clock, a testament to a legacy of quality and hard work. Yet, you’re constantly told that you must “embrace the AI revolution” or risk being left behind. The advice is often abstract, expensive, and seems disconnected from the reality of your shop floor, your experienced team, and your bottom line.

Most guides talk about AI as a monolithic force you must adopt. They push for massive digital transformation, glossing over the real-world challenges of integrating new systems into an established operational DNA. This often leads to investing in hype technology that fails to solve a tangible problem, causing frustration and financial loss.

But what if the goal isn’t to simply “buy AI”? What if the true path to innovation lies in a more pragmatic, calculated approach? The key is to shift your mindset from a tech problem to a strategic investment problem. It’s about de-risking the entire process, making small, intelligent bets, proving value at every step, and leveraging the unique financial tools available to Canadian manufacturers.

This guide offers a clear, sequential framework to do just that. We will break down how to manage cultural resistance, run low-risk pilot projects, make the critical “build vs. buy” decision, and, most importantly, calculate a realistic return on investment—all while maximizing uniquely Canadian programs like SR&ED. This is your playbook for honouring your company’s past while building its resilient, intelligent future.

This article will guide you through the critical strategic decisions for integrating AI. From managing your team to calculating financial returns, each section provides a clear, actionable perspective for a legacy business leader.

Summary: A Leader’s Roadmap to AI Integration in Manufacturing

- Why Your Senior Staff Resists New Tech and How to Fix It?

- How to Automate Operations When Hiring Costs Are Rising by 15%?

- How to Run a Low-Risk Pilot Program Before Committing $50k?

- Why Holding Cash Is Sometimes the Best Strategic Investment?

- The Mistake of Investing in Hype Tech That Solves No Real Problem

- Build In-House vs. Buy SaaS: Which Innovation Strategy Yields Better ROI?

- How to Calculate the ROI of New Machinery Before Signing the Purchase Order?

- How to Maximize Your SR&ED Claim for Experimental Development?

Why Your Senior Staff Resists New Tech and How to Fix It?

Your most experienced employees resist new technology not because they are stubborn, but because they fear it will devalue their decades of accumulated wisdom. They see complex AI systems as a threat to their identity and job security. The key to overcoming this is to frame AI not as a replacement for human expertise, but as a powerful tool to augment their knowledge and reduce their physical and mental burdens.

Instead of leading with technology, lead with a problem they already face. Is quality control a constant headache? Are they spending hours on tedious manual inspections? Position a new AI tool, like a computer vision system, as a way to give them “superpowers”—allowing them to focus their expertise on solving the root cause of defects rather than just finding them. This reframes the conversation from replacement to empowerment.

Case Study: Thomson Precision Manufacturing’s Cobot Integration

In Vancouver, Thomson Precision Manufacturing faced a similar challenge with an aging workforce. They integrated AI-based collaborative robots (cobots) specifically to reduce physical strain and assist with repetitive tasks. This move was framed as supporting their experienced staff, not sidelining them. The results were clear: the implementation led to a 42% improvement in product consistency and a 27% decrease in customer returns within the first year, proving how AI can successfully augment, rather than replace, valuable human workers.

Start with pilot projects that tackle well-defined challenges and demonstrate immediate value to the team. By focusing on workforce development with comprehensive training and framing AI adoption as a way to secure the company’s future, you build on their operational wisdom instead of discarding it. This approach turns your most skeptical veterans into your most valuable champions.

How to Automate Operations When Hiring Costs Are Rising by 15%?

When skilled labour is scarce and expensive, the most strategic response is not just to hire more people, but to multiply the effectiveness of the team you already have. Automation, powered by AI, allows you to do just that by targeting low-value, repetitive tasks and freeing up your skilled operators for high-value work that requires human judgment. This is a critical lever for improving efficiency and protecting margins.

This is a sentiment echoed by industry experts who see technology as an unavoidable path to efficiency. As Paul Dostaler, Partner and Manufacturing Industry Lead at BDO Canada, states:

Canadian manufacturers don’t have a choice but to adapt. They have to build in efficiency and cost cutting, and perhaps the easiest way to do that is to apply technology to their day-to-day.

– Paul Dostaler, Partner, Manufacturing Industry Lead at BDO Canada

The opportunity for Canadian manufacturers is significant. While research from The Dais reveals that 4.6% of Canadian manufacturers have adopted AI—slightly above the national average of 4.1%—it shows that the field is still wide open. Early, strategic adoption provides a distinct competitive advantage. The goal isn’t 100% automation, but smart automation that enhances human oversight, as shown below.

By automating tasks like quality inspection, material handling, or predictive maintenance scheduling, you directly address rising labour costs. An AI system can inspect thousands of parts per hour with unwavering consistency, allowing your best quality control expert to focus on process improvement and training. It’s a strategic shift from spending money on more labour to investing in scalable operational capacity.

How to Run a Low-Risk Pilot Program Before Committing $50k?

A successful AI journey begins with a small, measurable win, not a large, risky bet. To run a low-risk pilot, you must first define a “Minimum Viable Problem”—the single, most specific bottleneck on your shop floor that, if solved, would deliver a noticeable impact. Instead of “improving quality,” aim for “reducing scrap rate on Line 3 by 5% in Q2.”

This focused approach is gaining traction; 14.5% of Canadian businesses plan AI pilots in the next year, recognizing the value of testing the waters first. Your pilot’s goal is not just to test the technology, but to test the entire process: data collection, integration with existing machinery, and your team’s interaction with the new system. Set clear KPIs before you start, a timeline of no more than 90-120 days, and a budget that you can afford to lose—though the goal is to prove you won’t.

Critically, leverage Canadian support systems designed for this exact purpose. The National Research Council of Canada’s Industrial Research Assistance Program (NRC IRAP) offers funding and advisory services to help de-risk these exact types of experimental projects. Tapping into programs like IRAP is a powerful strategic move, as Canadian manufacturers using this funding are reportedly 2.5 times more likely to successfully scale their AI implementations. This turns a simple tech pilot into a fiscally intelligent experiment in strategic innovation.

Why Holding Cash Is Sometimes the Best Strategic Investment?

In a rapidly evolving tech landscape, the pressure to “invest or be left behind” is immense. However, for a legacy business, rushing into a significant capital expenditure on unproven AI can be a fatal mistake. Sometimes, the most powerful strategic move is to preserve your capital. Holding cash provides “strategic optionality”—the flexibility to act decisively when the right opportunity, not just any opportunity, arises.

Your hesitation is not a weakness; it’s a shared sentiment. Recent Statistics Canada data shows that 18.9% of Canadian businesses remain uncertain about their AI adoption plans. This uncertainty is healthy. It prevents you from chasing hype and allows you to observe how the technology matures and which applications deliver real-world value in environments similar to yours.

Furthermore, a strong cash position is a powerful negotiating tool. A KPMG survey highlighted that companies with healthy cash reserves were able to negotiate better terms with AI vendors and, more importantly, fund proper, thorough pilot programs without resorting to unfavorable financing. This financial strength allowed them to de-risk the implementation process, leading to a smoother integration and a higher probability of achieving positive ROI. In a volatile market, cash isn’t just sitting idle; it’s waiting for the right moment to capture a well-vetted, high-impact opportunity.

The Mistake of Investing in Hype Tech That Solves No Real Problem

The single biggest mistake in AI adoption is starting with a solution instead of a problem. Many businesses get dazzled by a technology like “generative AI” or a “digital twin” and then search for a way to use it, rather than identifying a painful, costly operational issue and seeking the best tool to solve it. This backward approach is the primary reason for failed innovation projects.

The data is stark: a survey from Statistics Canada reveals that an overwhelming 78.1% of businesses not adopting AI cite ‘not relevant to goods/services’ as the main reason. This isn’t a failure of AI; it’s a failure of problem-framing. Before you ever speak to a vendor, you must perform an internal audit to find your “Minimum Viable Problem.” This requires a ruthless focus on tangible issues that impact your P&L, such as excessive changeover times, high scrap rates, unexpected machine downtime, or product defects leading to returns.

Once you have a list of real problems, you can begin mapping potential AI solutions to them. For example, computer vision for defect detection, or predictive analytics for machine maintenance. This grounds your entire strategy in operational reality. The goal is to find the smallest, most specific problem where a solution would have a noticeable and measurable impact. This is the foundation of a business case that makes sense to you, your controller, and your shop-floor manager.

Action Plan: Your AI Readiness Audit

- List Shop-Floor Pains: Document the top 5 recurring problems that cost you time or money (e.g., changeover time, scrap rate, quality defects, machine downtime).

- Map Potential Solutions: For each problem, research if a mature AI solution exists (e.g., computer vision, predictive analytics, process optimization).

- Define the Minimum Viable Problem: Select the one problem that is both highly specific and offers a clear, measurable impact if solved. This is your pilot project.

- Differentiate Solution Types: Distinguish between AI as a small ‘feature’ within your existing software versus a standalone ‘AI product’ requiring significant investment.

- Assess Data Readiness: Confirm you have the necessary data (and a way to collect it) to train or implement an AI solution for your chosen problem.

Build In-House vs. Buy SaaS: Which Innovation Strategy Yields Better ROI?

Once you’ve identified your problem, you face a critical strategic fork in the road: do you develop a custom AI solution in-house, or do you subscribe to an existing Software-as-a-Service (SaaS) platform? There is also a third way: a hybrid partnership. The right choice depends entirely on your risk tolerance, long-term goals, and potential for leveraging tax incentives like SR&ED.

Building in-house offers complete control and data sovereignty, and the development work is highly eligible for SR&ED claims. However, it requires a massive upfront investment ($200K+) and a fierce competition for rare, expensive AI talent. Buying a SaaS solution is faster, cheaper initially, and has low talent dependency, but you have little control over the product roadmap, your data may be hosted off-site, and SR&ED potential is minimal. The hybrid model, often involving a partnership with a specialized Canadian tech firm, can offer a balance of customization and speed.

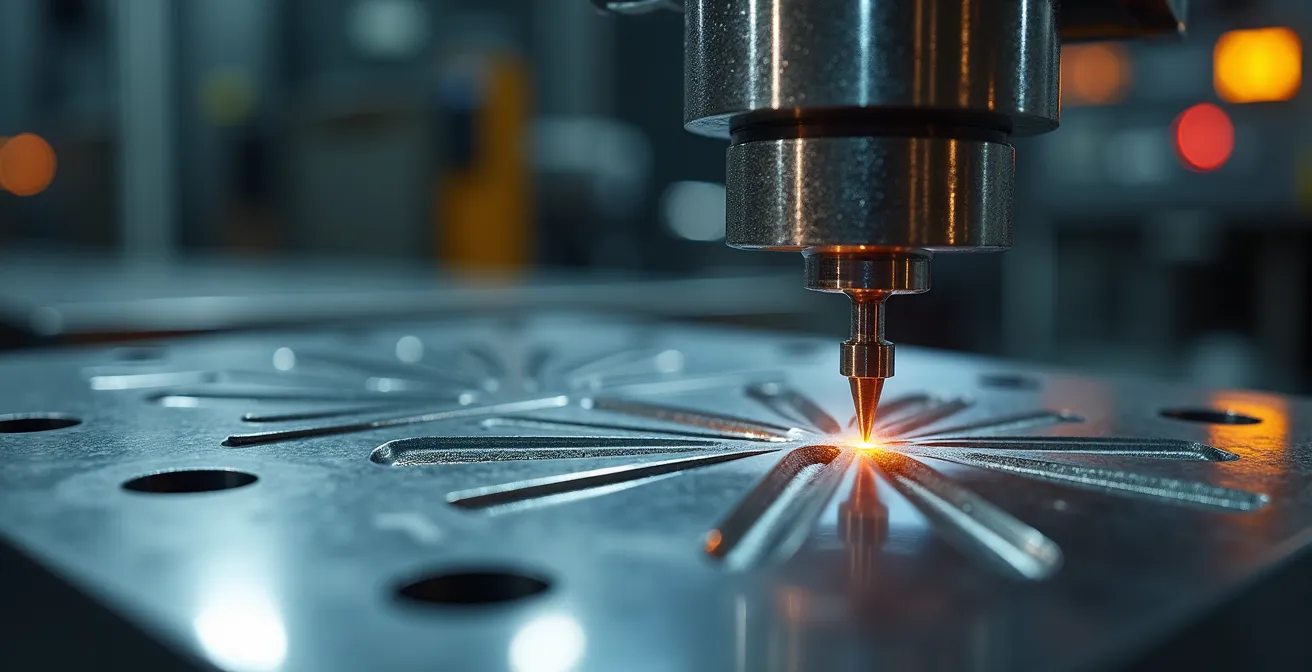

This visual represents the ideal hybrid partnership, where your industrial expertise and a tech partner’s digital skills combine to create a solution tailored to your specific needs.

The following table, based on insights from sources like a KPMG analysis for Canadian manufacturers, breaks down the key trade-offs. Notice how factors like SR&ED potential and data control—critical for Canadian businesses—vary dramatically between strategies.

| Strategy | SR&ED Claim Potential | Data Sovereignty | Talent Dependency Risk | Initial Investment |

|---|---|---|---|---|

| Build In-House | High (Full experimental development) | Complete control | Very High | $200K-500K |

| Buy SaaS | Minimal | Vendor dependent | Low | $50K-150K/year |

| Hybrid Partnership | Moderate to High | Shared control | Moderate | $100K-300K |

How to Calculate the ROI of New Machinery Before Signing the Purchase Order?

To calculate the true ROI of AI-enabled machinery, you must look beyond traditional metrics. While a conventional machine’s ROI is primarily based on direct labour savings, an intelligent machine’s value comes from second and third-order benefits: improved quality, reduced waste, and, crucially, the generation of data that will fuel future improvements. A proper ROI calculation must quantify these benefits.

First, move beyond simple payback period. Model the financial impact of a significant reduction in defects. If an AI vision system can cut your defect rate from 5% to 1%, what does that mean in terms of reduced material waste, fewer customer returns, and less time spent on rework? These are hard numbers that belong in your ROI model. Second, factor in the value of throughput. If predictive maintenance reduces unplanned downtime by just 10%, how many more units can you produce and sell per year?

Most importantly for a Canadian manufacturer, the calculation must include the potential SR&ED tax credit. Integrating an AI system into your unique “brownfield” factory environment almost always involves overcoming technological uncertainties, which is the definition of experimental development. This can reduce the net cost of the machinery by 15-35%, dramatically shortening the payback period and strengthening the business case.

This table illustrates the fundamental differences in calculating ROI for traditional versus AI-enabled equipment.

| ROI Factor | Traditional Machinery | AI-Enabled Machinery |

|---|---|---|

| Direct Labor Savings | Primary benefit | Secondary benefit |

| Quality Improvements | 5-10% reduction in defects | 35% average reduction (Ontario data) |

| Data Generation Value | None | Enables future process improvements |

| SR&ED Tax Credit | Not applicable | Can reduce net cost by 15-35% |

| Payback Period | 3-5 years | 1.5-3 years with credits |

Before signing any PO, present two ROI scenarios to your partners and lenders: one without SR&ED and one with the post-credit net investment. This demonstrates financial diligence and presents the most realistic picture of the investment’s true potential.

Key Takeaways

- AI adoption is an investment problem, not a tech problem. Success hinges on de-risking every step.

- Start with a small, measurable pilot on a “Minimum Viable Problem” to prove value before committing significant capital.

- Leverage uniquely Canadian advantages like the SR&ED program to significantly reduce the net cost and improve the ROI of your AI projects.

How to Maximize Your SR&ED Claim for Experimental Development?

For Canadian manufacturers, the Scientific Research and Experimental Development (SR&ED) tax incentive program is the single most powerful tool for de-risking AI investment. The key to a successful claim is understanding that the “experimental development” lies not in creating a new AI algorithm, but in overcoming the technological uncertainty of making an existing AI work within your specific, non-ideal factory environment.

The Canada Revenue Agency (CRA) is looking for a systematic investigation to advance your company’s technological knowledge. Your project is not just “evaluating a purchase”; it is an experiment to answer a technological question. According to analysis of these “brownfield” challenges, this integration work is a core qualifier. To maximize your claim, meticulous documentation from day one is non-negotiable. You must frame the project’s primary purpose as the advancement of technological knowledge.

Your documentation should rigorously track the entire experimental process. This includes:

- Technological Uncertainty: Clearly state your initial hypothesis. For example: “Can we achieve 99% defect detection accuracy using a standard computer vision model in our dusty, variable-lighting factory conditions?”

- Systematic Investigation: Keep a log of your experiments. Track the different approaches you took (e.g., testing different lighting setups, using generative AI to create synthetic defect images for training), what worked, and what failed.

- Technological Advancement: Document what you learned. Even if the project fails to meet its commercial goals, if you gained knowledge about what *doesn’t* work in your environment, that is a technological advancement.

- All Associated Costs: Remember to include not just the salaries of your engineers, but also a portion of the labour costs for machine operators, process engineers, and quality managers who supported the project.

By framing your AI pilot as a structured experiment from the outset, you transform a capital expenditure into a partially government-funded R&D project, significantly improving its financial viability.

The path to integrating AI is a marathon, not a sprint. It begins not with a purchase order, but with an internal audit to identify that first, high-impact problem. By adopting a mindset of strategic de-risking, running disciplined pilots, and leveraging powerful Canadian fiscal tools like SR&ED, you can guide your family’s legacy into its next chapter of innovation and growth.